Portugal Luxembourg Tax Treaty / Panama Tax Treaties Tax Panama

A Where a resident of a Portugal derives income which in accordance with the provisions of this Convention may be taxed in Luxembourg Portugal shall allow as a deduction from the tax on the income of that resident an amount equal to the tax paid in LuxembourgSuch deduction shall not however exceed that part of the income tax as computed before the deduction is given which is. The Convention will enable governments to swiftly update their networks of existing tax treaties and further reduce opportunities for tax avoidance.

Netherlands New Tax Treaty Tim Tax

Belgium - Netherlands Income and Capital Tax Treaty 2001 Art.

Portugal luxembourg tax treaty. A Luxembourg company paying royalties to a Polish one would also rather rely on. Signed on 6 November 2020 and ratified by both Russia and Luxembourg the protocol will entry into effect for taxable periods starting as from 1 January following the exchange of ratification instruments ie. Countries with pending treaties.

For the purpose of this article we are considering an individual as being tax resident in the UK and an additional country although double tax treaties can exist between any two countries. Portugal Luxembourg Tax Treaty. Albania - Andorra - Austria - Belgium - Bulgaria - Croatia - Czech Rep.

Since June 2017 nearly 80 countries have signed a new Multilateral Convention developed as part of the BEPS Project. France - Germany Income and Capital Tax Treaty 1959 Art. On 27 july 2009 the principality of monaco signed an agreement with luxembourg to avoid double taxation and.

This Convention is the first income tax treaty between the United States and Portugal. The DTAs and their Amending Protocols along with any Further Guidance should be read together. This Convention is the first income tax treaty between the United States and Portugal.

Countries with signed treaties. See list of Belgian tax treaties. If you are unsure of your UK tax residence status please read our article about the.

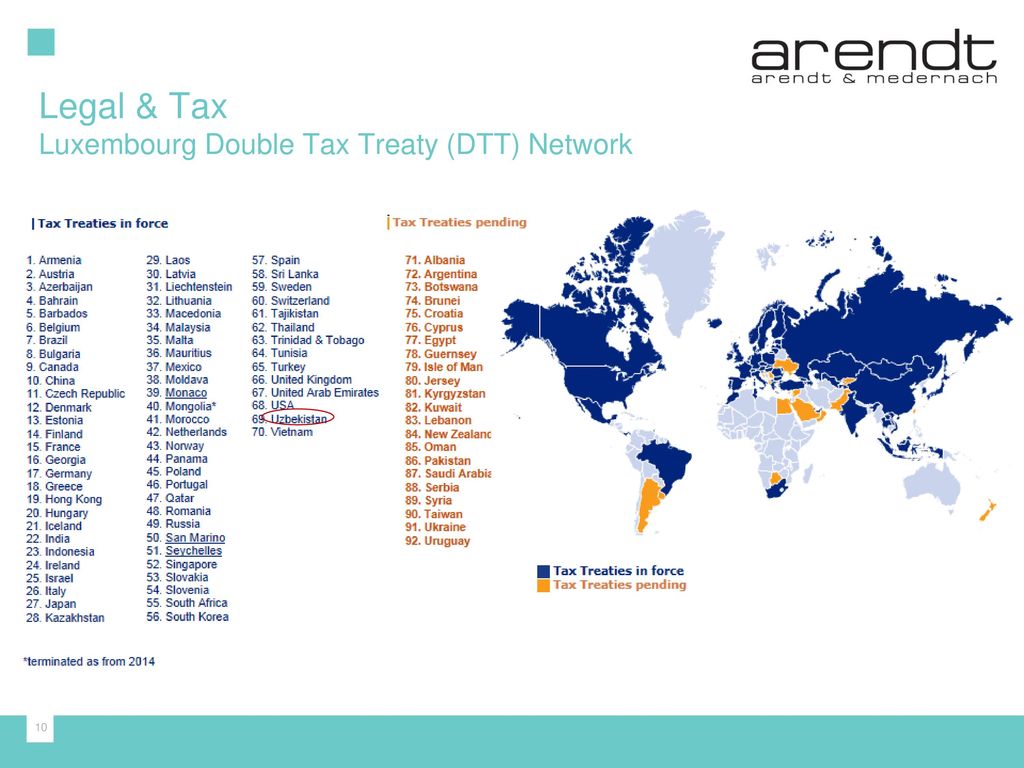

Profits of a foreign branch that are not exempt under a DTT may benefit from a foreign tax credit. The text of agreements and Amending Protocols is available by clicking on the links below. Click on any country for more information on the tax treaties signed by Luxembourg.

Withholding tax on royalties is reduced from 10 in the Double Tax Treaty to 5 in the Protocol. The rate of 10 applies if the beneficial owner is a company. Portugal Luxembourg Double Tax Treaty Taxation RC Brown Investment Management.

Portugal Luxembourg Tax Treaty. In this context the DTT introduces in particular new rules. Current List of Double Tax Treaties signed between Luxembourg and other European Countries.

Countries with signed treaties. Dividends WHT reduction to 5 only applicable to. List of countries with.

10 March 2020 Please rate how useful this page was to you Print this page Print all pages in Double Taxation Treaties. The rate of 5 on dividends applies if the beneficial owner is. Breast cancer accounts for almost a quarter of n.

118 rows So far Luxembourg has concluded 117 tax treaties and is party to a series of treaties under. The DTT will incorporate inter alia the latest OECD approach reflected in the 2017 version of the OECD Model Tax Convention and in the Multilateral Convention to Implement Tax Treaty Related Measures. Strenghtening tax treaties to fight tax avoidance.

As such it represents an important addition to the US. See list of Danish tax treaties. On February 24 2011 the Portuguese Council of Ministers approved the proposal of a resolution that approves the protocol amending the DTT signed between Portugal and.

Income tax conventions this Convention provides rules specifying when income that arises in one of the countries and is derived by residents of the other country may be taxed by the country in which the income. Andorra more info Armenia. Tax treaties by country.

- Cyprus - Denmark - Estonia - Finland - France - Germany - Greece - Guernsey - Hungary - Iceland - Ireland - Isle of Man - Italy - Jersey - Lettonia - Liechtenstein - Lithuania -. The west of the country offers a diverse cultural heritage from roman sites to castles over to various industrial monuments. Luxembourg and France signed a new double tax treaty the DTT replacing the double tax treaty that was signed on 1 April 1958.

Countries with applicable treaties. Double Tax Treaties Tax Treaty Agreements. I in the case of Portugal the state a political or administrative subdivision or a local authority thereof or the Bank of Portugal.

Each double tax treaty is different although many follow very similar guidelines - even if the details differ. The 81 double tax avoidance agreements currently in force between Portugal and other jurisdictions are given in the table below. Also provided is the year that the most recent treaty between the two territories went into force.

Tax Alert Russia Luxembourg tax Treaty Progress Double. The 10 rate applies in all other cases. Where a resident of Luxembourg derives.

Belgium - Germany Income and Capital Tax Treaty 1967 Art. Luxembourg tax treaties have the same purpose as most bilateral. II of the Protocol.

The 5 rate applies if the beneficial owner is a company other than a partnership that directly or indirectly holds. See list of Belgian tax treaties. Denmark - Faroe Islands - Finland - Iceland - Norway - Sweden Income and Capital Tax Treaty Nordic Convention 1996 Art.

Portugal Luxembourg Double Tax Treaty - double Archives - HKWJ Tax Law - A tax treaty is an agreement between two countries regarding how they tax each others citizens. The 0 rate applies if the conditions of the Luxembourg participation exemption regime are met. Luxembourg tax treaties have the same purpose as most bilateral agreements are designed to address specific economic context for each country.

Ii in the case of the Sultanate of Oman its government the Central Bank of Oman the states general reserve fund or the Omani Investment Fund. The Convention is expected to enter into force in mid-2018. Tax treaties concluded by luxembourg ar.

Luxembourg Portugal Tax Treaty Tax Treaties Database Global Tax Treaty Information Ibfd In effect it is a program that allows qualifying individuals the opportunity to the tax residency is good for 10 years and does not come with the typical obligation that you visit or live in portugal part of the year to maintain your tax. See more information about portuguese taxes. I of the Protocol and Art.

Under a tax treaty foreign country.

Russia Has Notified Luxembourg And Malta Of Tax Treaty Changes

Double Tax Treaties In Luxembourg

Guiding You Through Portugal S Non Habitual Residence Tax Nhr Mygrate Investments

Uk Provides Update On Tax Treaty Negotiation Plans Orbitax News

Luxembourg Taxation Of International Executives Kpmg Global

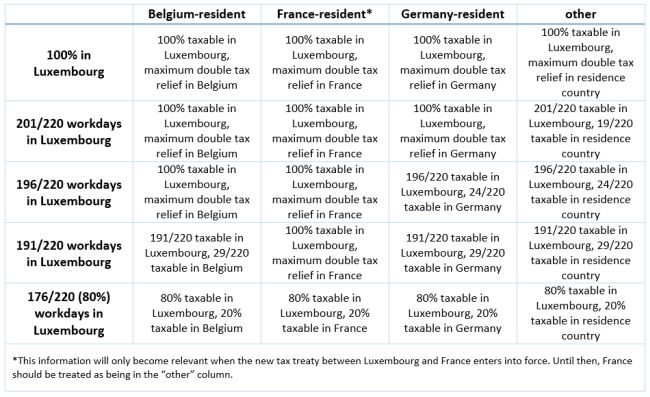

Tax And Social Security For Cross Border Commuters Home Workers Employment And Hr Luxembourg

Double Tax Treaties In Portugal We Assist Foreign Investors

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

European Tax Treaties Tax Treaty Network Of European Countries

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Panama Tax Treaties Tax Panama

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

The Mcdonald S State Aid Case The Eu Commission Interprets A Tax Treaty Kluwer International Tax Blog

What Is The Uk Portugal Double Taxation Treaty And How Does It Affect Business Owners Rhj Accountants Associates

Luxembourg Uzbekistan Business Relations A Focus On Financial Services Ppt Download